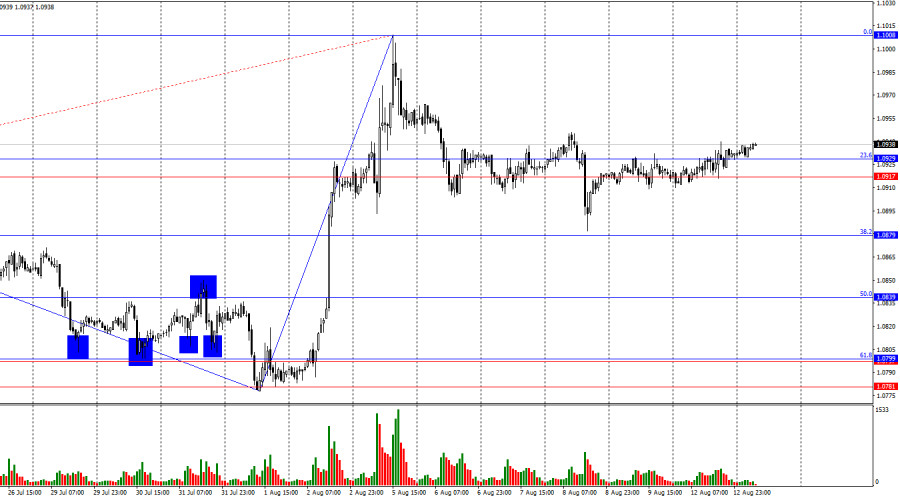

On Monday, the EUR/USD pair managed to consolidate above the resistance zone of 1.0917 – 1.0929. I have previously mentioned that this zone is not particularly strong at the moment, and strong trading signals should not be expected around it. I do not consider the consolidation above this zone to be a signal for a renewed rise toward the 0.0% corrective level at 1.1008. The news remains weak, so trader activity today may also be low.

The wave structure has become slightly more complex, but there are no significant concerns overall. The last completed downward wave did not break the low of the previous wave, while the last upward wave did break the peak from July 16th. Thus, the bullish trend is still intact. For the bullish trend to be canceled, the bears now need to break the low of the last downward wave, which is around the 1.0778 level. Even better would be to consolidate below the important zone of 1.0781 – 1.0799, which serves as the strongest support.

The news on Monday had no impact on traders' actions. There were no important reports or events throughout the day. Thus, the wisest course of action now is to wait for the first significant reports of the week. However, we will have to wait at least until tomorrow. Today, the European Union and the United States will release several interesting indicators, including the U.S. Producer Price Index. This indicator is one of those that directly affects inflation and core inflation. The market is expecting a further slowdown in inflation, which would support its expectations for a 0.50% rate cut by the Federal Reserve in September. If the Producer Price Index today and the Consumer Price Index tomorrow come in below expectations, bullish traders might become more active, and the EUR/USD pair could head towards 1.1008. However, the situation could also turn in favor of the U.S. dollar if there is no slowdown in inflation.

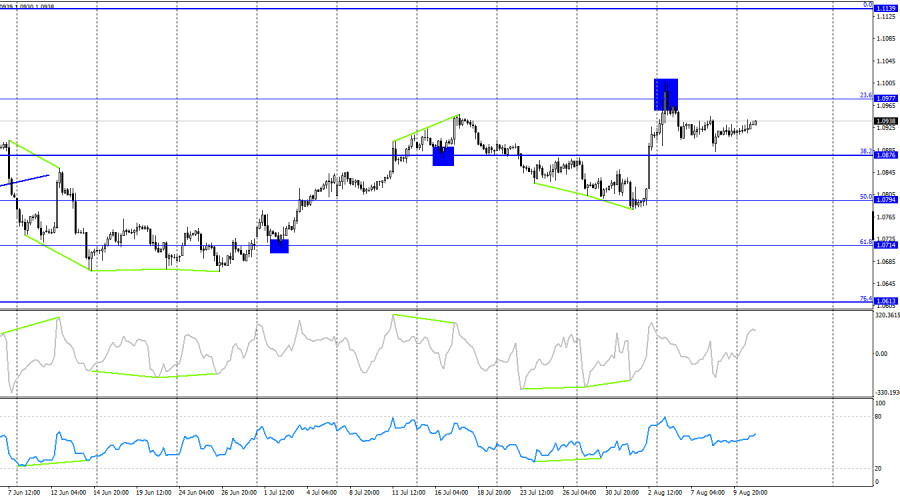

On the 4-hour chart, the pair rebounded from the 23.6% corrective level at 1.0977, reversing in favor of the U.S. dollar. Thus, the decline in quotes may resume towards the 38.2% Fibonacci level at 1.0876. Consolidating the pair above the 1.0977 level will increase the likelihood of further growth towards the next corrective level at 0.0% – 1.1139. No impending divergences are observed in any of the indicators today.

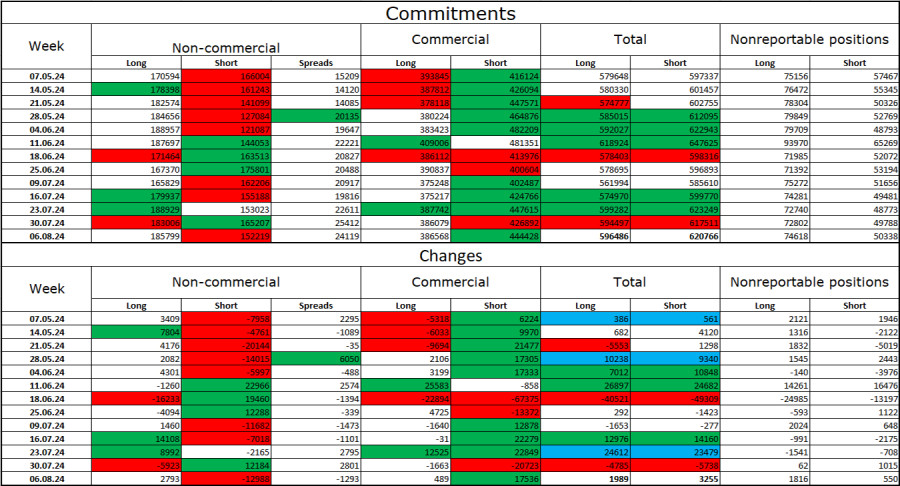

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2,793 long positions and closed 12,988 short positions. The sentiment of the "Non-commercial" group turned "bearish" a few months ago, but currently, the bulls have regained dominance. The total number of long positions held by speculators now stands at 186,000, while short positions total 152,000.

I still believe that the situation will continue to shift in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has begun easing its monetary policy, which will lower the yields on bank deposits and government bonds. In the U.S., these yields will remain high at least until September, making the dollar more attractive to investors. The potential for a significant decline in the euro remains high. However, we should not forget about the technical analysis, which currently does not give a clear signal for a strong decline in the euro, and also about the news background, which regularly creates obstacles for the dollar.

News Calendar for the U.S. and the Eurozone:

- Eurozone – ZEW Economic Sentiment Index (09:00 UTC).

- Germany – ZEW Economic Sentiment Index (09:00 UTC).

- U.S. – Producer Price Index (12:30 UTC).

The August 13th economic calendar includes a few moderately significant entries. The impact of the news background on trader sentiment today is expected to be weak.

EUR/USD Forecast and Trading Recommendations:

Sales of the pair are possible with a target of 1.0879 on the hourly chart if there is a consolidation below the support zone of 1.0917 – 1.0929. Purchases will be possible upon consolidation above the support zone of 1.0917 – 1.0929 on the hourly chart with a target of 1.1008. However, in both cases, strong growth or decline should not be expected. Most likely, the targets will not be reached.

The Fibonacci levels are drawn from 1.0668 to 1.1008 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.