The GBP/USD currency pair surged on Wednesday and continued its rally on Thursday. Recall that in yesterday's articles, we did not discuss the FOMC meeting, its results, and Jerome Powell's speech. We believe that enough time should pass after the meeting for the market's passions to settle. It often happens that the pair moves in one direction immediately after the FOMC meeting, only to return to its original position by morning. However, this time was different.

This time, the market reacted exactly as it should have. The key interest rate was cut, so the dollar's decline was entirely reasonable. It is important to note that the market often loves to price in the Federal Reserve's decisions that are already known in advance. Therefore, on the days results are announced, we observe movements that contradict rational logic. But why didn't the dollar strengthen this time, given that a rate cut was known a month ago? Because the dollar had been rising more often than it was falling over the past five months. The last two rounds of Fed easing, for some reason, led to a strengthening of the US currency. The British currency hasn't seen an objectively significant amount of negativity that would warrant a nearly 50% correction against the dollar (on the daily timeframe). During the same period, the euro only managed a paltry 23.6% correction. In fact, it has hardly corrected since the pair has been range-bound for six months. A sideways range and a correction are not the same.

Now the British pound has three significant events to navigate. First, the macroeconomic data on labor, unemployment, and inflation in the US will be released next week. Second, the Bank of England's meeting and the likely reduction of the key interest rate will also take place next week. Third, the Senkou Span B line on the daily timeframe. With regard to the macroeconomic data in the US, it's straightforward. The slower inflation rises, the more quickly the Fed will resume easing policy. The worse the labor market conditions, the faster the Fed will restart easing.

The BoE's meeting is a bit more complicated. The BoE is likely to cut the key rate, although it cannot be stated with certainty that UK inflation is declining. Yet this decision has been well known to traders for quite some time. At the last meeting, the "hawks" edged out the "doves" by the narrowest of margins. It's evident that the "doves" will win at the December meeting. Therefore, the British pound should not fall significantly.

The Senkou Span B line is a strong technical resistance level at 1.3364. The price settled above this line yesterday, so the barrier has been breached. If the next week does not bring fundamental disasters for the British currency, we expect a strong rise in the pair before the end of the year. In a "thin market," moving upward will be easier.

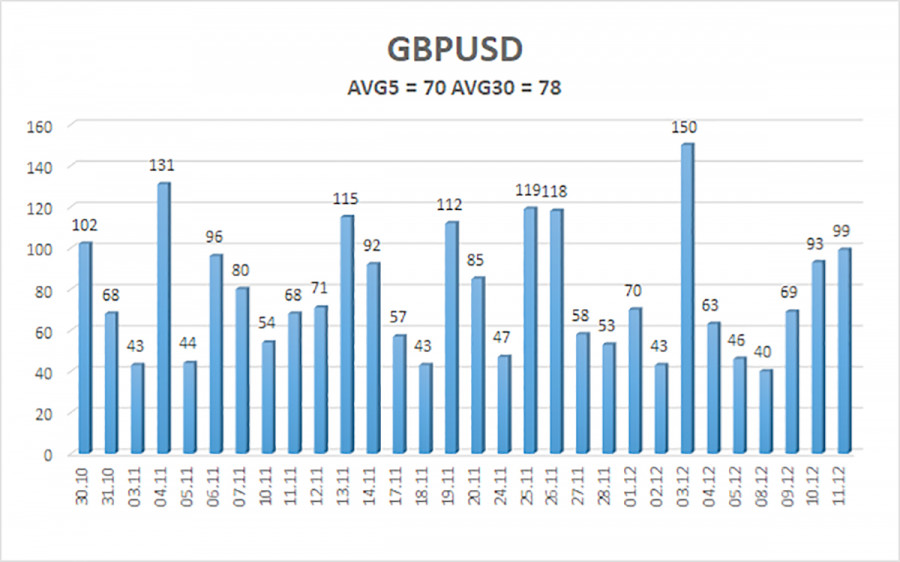

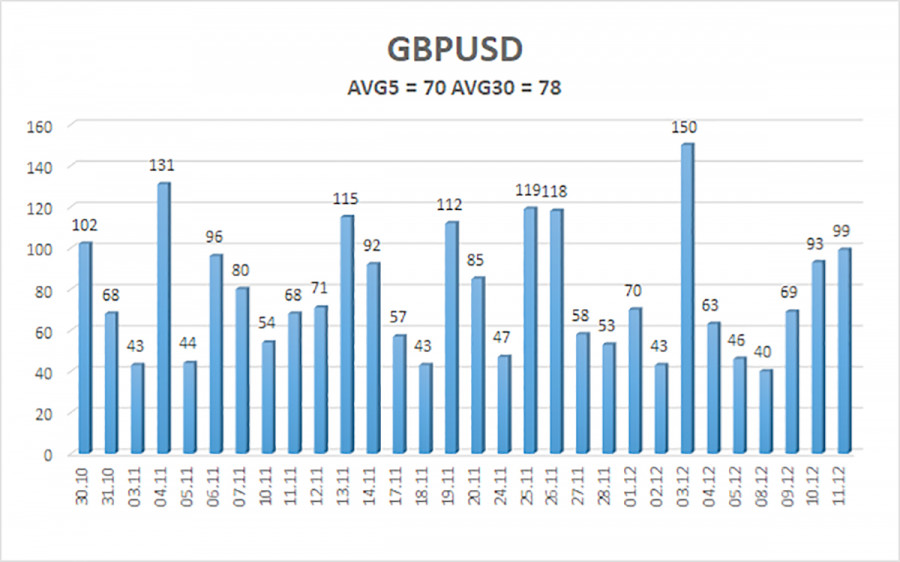

The average volatility of the GBP/USD pair over the last five trading days, as of December 12, is 70 pips, characterized as "medium." On Friday, December 12, we expect the pair to move within the range limited by levels 1.3356 and 1.3496. The linear regression channel points downward, but it is solely due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area 6 times in recent months and has formed several bullish divergences, suggesting a potential resumption of the upward trend. Last week, the indicator "visited" the overbought area, and two days ago it formed another bullish divergence, while today it has entered the overbought area again. A downward pullback should not be strong.

Nearest Support Levels:

- S1 – 1.3306

- S2 – 1.3245

- S3 – 1.3184

Nearest Resistance Levels:

- R1 – 1.3428

- R2 – 1.3489

- R3 – 1.3550

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its upward trend in 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the US currency to appreciate. As a result, long positions with targets at 1.3489 and 1.3550 remain relevant for the near term while the price is above the moving average. If the price is below the moving average, small shorts can be considered with targets at 1.3245 and 1.3184 on technical grounds. Occasionally, the US currency shows corrections (on a global scale), but for trend-based strengthening, it needs signs of the end of the trade war or other global positive factors.

Notes on Illustrations:

- Support and resistance price levels (resistance/support) — thick red lines near which the movement may end. They are not sources of trading signals.

- The Kijun-sen and Senkou Span B lines are Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour timeframe. They are considered strong lines.

- Extreme levels are thin red lines from which the price has previously bounced. They are sources of trading signals.

- Yellow lines denote trendlines, trend channels, and any other technical patterns.

- Indicator 1 on COT charts shows the net position size of each category of traders.