Analysis of Trades and Trading Tips for the British Pound

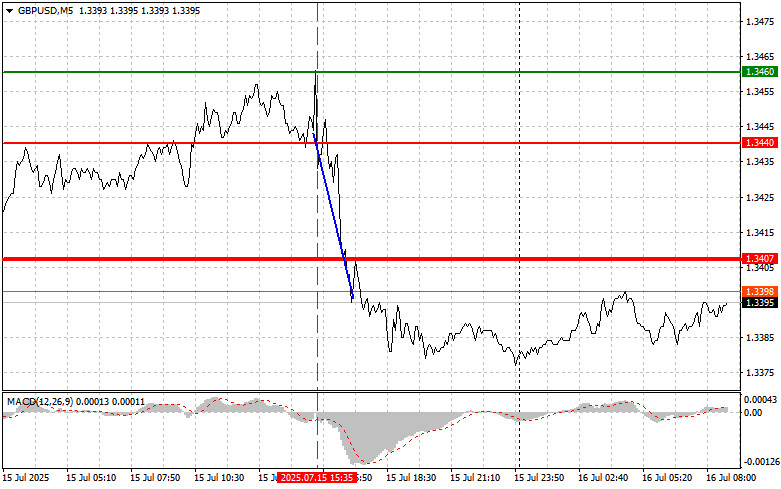

The test of the 1.3440 price level coincided with the MACD indicator just beginning its downward movement from the zero mark, confirming the correct entry point for selling the pound and resulting in a drop of over 40 pips.

The rise in the U.S. Consumer Price Index in June was the largest monthly increase since the start of the year, providing notable support for the U.S. dollar. Although the acceleration in inflation wasn't sharp, it prompted investors to reassess their forecasts. Now that the data indicate persistent inflationary pressure, the likelihood of imminent monetary easing by the Federal Reserve has decreased. This, in turn, led to a strengthening of the dollar against other major currencies, as higher interest rates make U.S. assets more attractive to investors.

Today, the British pound may gain ground if the inflation data published in the United Kingdom exceeds analysts' expectations. An acceleration in inflation would undermine speculation about potential monetary policy easing by the Bank of England. In the current environment of economic instability, inflation figures become crucial. If inflation comes in higher than forecast, the Bank of England may be forced to adopt a more conservative stance, which would support the pound. If inflation fails to meet expectations or other negative factors emerge, the pound may remain under pressure from sellers.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

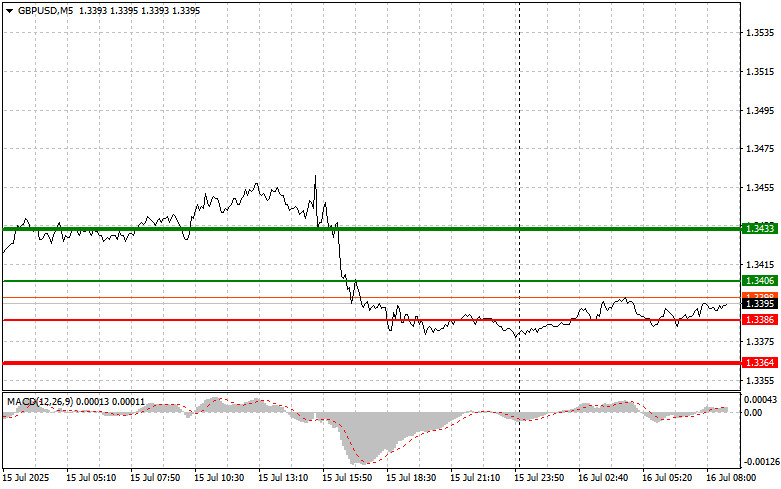

Scenario #1: I plan to buy the pound today at the entry point around 1.3406 (green line on the chart) with a target of 1.3433 (thicker green line on the chart). Around 1.3433, I intend to exit long positions and open short positions in the opposite direction (targeting a 30–35 pip move back from that level). Pound growth today can be expected only in response to high inflation in the UK.

Important! Before buying, ensure the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3386 price level while the MACD indicator is in oversold territory. This will limit the pair's downside potential and lead to a market reversal to the upside. Growth toward the opposite levels of 1.3406 and 1.3433 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after the 1.3386 level is updated (indicated by the red line on the chart), which would likely lead to a sharp decline in the pair. The sellers' key target will be the 1.3364 level, where I plan to exit short positions and open long positions in the opposite direction (targeting a 20–25 pip rebound from the level). Selling the pound on a rise can be seen as a continuation of the bearish trend.

Important! Before selling, ensure the MACD indicator is below the zero mark and is just beginning to move downward from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3406 price level while the MACD indicator is in overbought territory. This will limit the pair's upward potential and trigger a market reversal to the downside. A decline toward the opposite levels of 1.3386 and 1.3364 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.