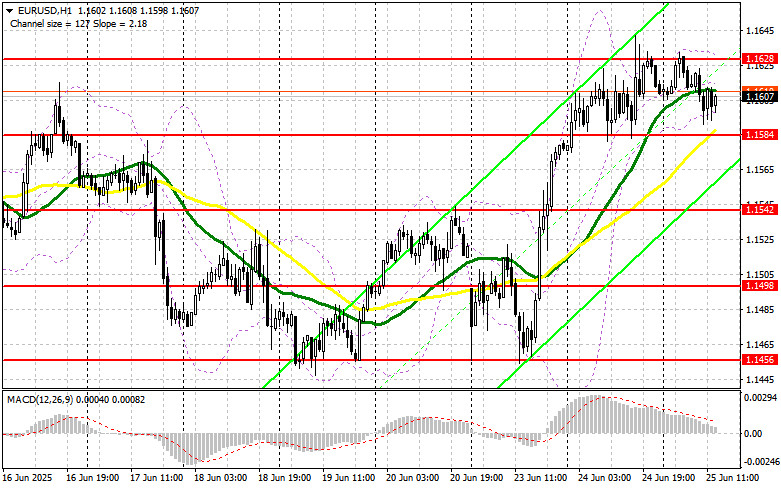

In my morning forecast, I highlighted the 1.1584 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. A decline did occur, but the price never reached that level, so I remained without any trades. The technical outlook has not changed for the second half of the day.

To open long positions on EUR/USD:

The lack of statistics from the Eurozone has taken its toll, causing the EUR/USD pair to stall in a narrow range without significant movement. In the second half of the day, U.S. new home sales data and Federal Reserve Chair Jerome Powell's speech are expected. It's unlikely Powell will say anything new that he didn't already mention yesterday before the House Financial Services Committee, so we're unlikely to see strong demand for the U.S. dollar.

If the euro declines following the data, I will act near the 1.1584 support level — which we didn't quite reach earlier. A false breakout there would be a signal to buy EUR/USD in anticipation of a recovery and a retest of the 1.1628 resistance. A breakout and retest of that area will confirm the correct entry point, aiming for 1.1666. The ultimate target will be 1.1699, where I will take profit.

If EUR/USD declines and there is no activity around 1.1584, pressure on the pair will increase, likely leading to a deeper drop. Bears could then reach 1.1542. Only after a false breakout form will I consider buying the euro. I plan to open long positions on a rebound from 1.1498, aiming for an intraday upward correction of 30–35 points.

To open short positions on EUR/USD:

Sellers attempted to apply pressure in the first half of the day, but without much success. The potential for euro growth remains, but it would require weak U.S. data and a dovish tone from Powell — similar to what we heard yesterday.

A false breakout around 1.1628 would be a signal for short positions, targeting support at 1.1584, where the moving averages currently favor the bulls. A breakout and consolidation below this range would be an appropriate selling opportunity, with a move toward 1.1542. The final target will be the 1.1498 level, where I will take profit.

If EUR/USD rises further in the second half of the day and there's no bearish activity near 1.1628, buyers may attempt to establish a new bullish trend and push the pair toward 1.1666. I'll only sell there if a failed consolidation occurs. Otherwise, I plan to open short positions on a rebound from 1.1699, aiming for a 30–35 point downward correction.

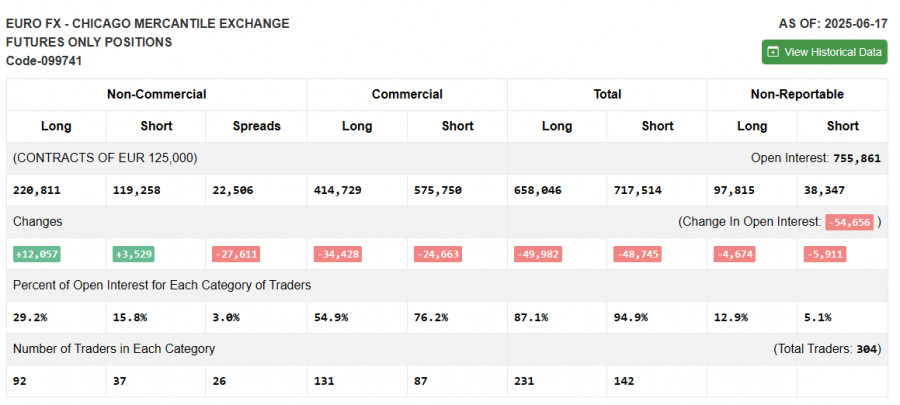

COT Report (Commitments of Traders) – June 17:

The June 17 COT report showed an increase in both long and short positions. The Fed's decision to keep rates unchanged supported the U.S. dollar, but the main driver of growth remained the Middle East conflict. Upcoming U.S. GDP data could influence the Fed's plans, and this will determine the future direction of EUR/USD.

According to the COT report, non-commercial long positions rose by 12,057 to 220,811, while short positions increased by 3,529 to 119,258. As a result, the gap between long and short positions narrowed by 27,611.

Indicator Signals:

Moving AveragesTrading is currently above the 30- and 50-day moving averages, indicating a continued bullish outlook for the euro.Note: The author analyzes the moving averages based on the H1 (hourly) chart, which differs from the classic definitions on the daily (D1) chart.

Bollinger BandsIn case of a decline, the lower boundary of the indicator near 1.1600 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise.

- Period 50 – marked in yellow on the chart

- Period 30 – marked in green

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: period 12

- Slow EMA: period 26

- Signal SMA: period 9

- Bollinger Bands:

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.