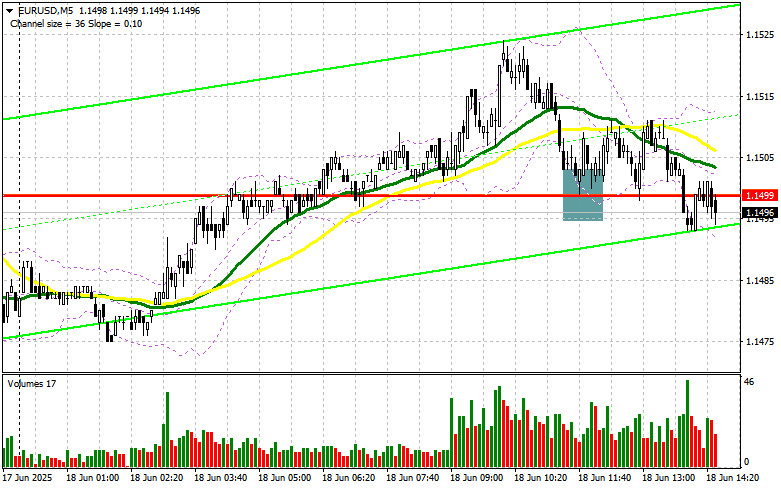

In my morning forecast, I highlighted the 1.1499 level and planned to base market entry decisions around it. Let's look at the 5-minute chart and break down what happened. A decline followed by a false breakout around 1.1499 provided a good entry point for buying the euro, but there was no significant upward movement. After a 10-point rise, euro demand faded again. The technical picture was revised for the second half of the day.

To open long positions on EUR/USD:

Inflation data in the eurozone matched economists' forecasts. Given that inflation is below 2.0%, this allows the European Central Bank to maintain a wait-and-see stance. Important U.S. data is ahead, including initial jobless claims and building permits, but the key event will be the FOMC rate decision and its accompanying economic forecast. The highlight will be Jerome Powell's press conference. If Powell's tone remains unchanged, the dollar could lose ground and continue to weaken.

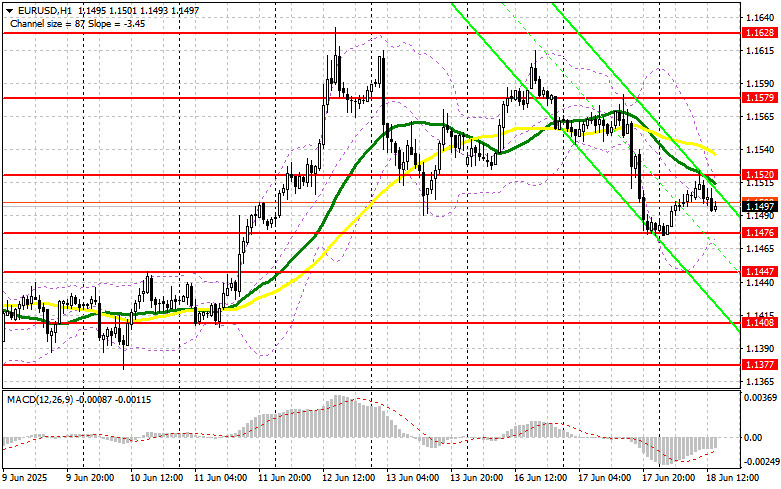

If the euro declines, I will act near the new support at 1.1476, formed earlier today. A false breakout there will signal a buying opportunity for EUR/USD with a view to continuing the bullish trend and retesting resistance at 1.1520, which the pair failed to break earlier. A breakout and retest of this range will confirm the correct entry point, targeting the 1.1579 level. The most distant target will be 1.1628—the monthly high—where I plan to take profit.

If EUR/USD drops and there's no activity around 1.1476, pressure on the pair will increase, likely pushing it toward 1.1447. Only after a false breakout at that level will I consider new long positions. I plan to open long positions on a rebound from 1.1408, targeting an intraday correction of 30–35 points.

To open short positions on EUR/USD:

Sellers are likely to step in if the Fed signals that it will maintain a hawkish stance for a longer period, potentially due to geopolitical uncertainty in the Middle East. In case of another upward attempt, a false breakout near 1.1520 will be a trigger for short positions, targeting support at 1.1476. A breakout and consolidation below this range will justify further selling toward 1.1447. The most distant target will be 1.1408, where I plan to take profit.

If EUR/USD rises in the second half of the day and bears show no activity around 1.1520—where the moving averages currently lie—buyers could drive the pair higher and retest 1.1579. I will consider selling only after a failed consolidation there. If there's no downward movement, I'll look to sell on a rebound from 1.1628 with an expected correction of 30–35 points.

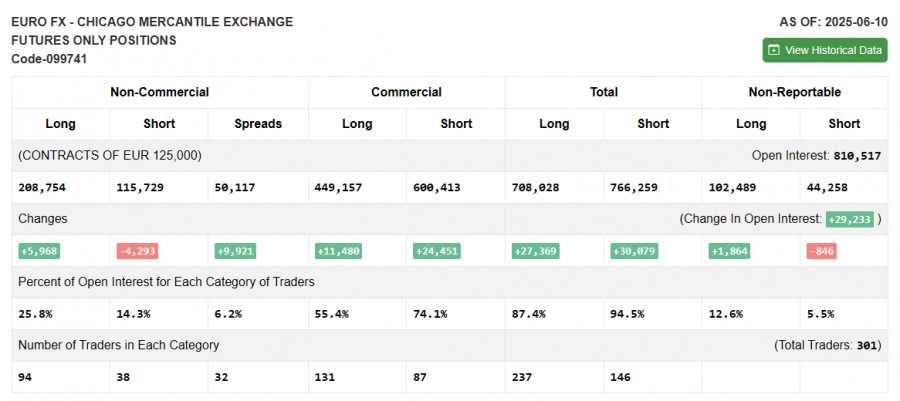

Commitment of Traders (COT) Report – June 10:

The latest COT report showed a decline in short positions and an increase in long positions. Despite a sharp drop in U.S. inflation, the dollar received no meaningful support, even though the Fed is expected to leave rates unchanged in the near term. What matters more is how Powell interprets the inflation outlook and the Fed's rate forecast for this fall. These factors will determine the future direction of the EUR/USD pair, which currently faces no obstacles to growth—as confirmed by the COT data.

According to the report, non-commercial long positions increased by 5,968 to 208,754, while short positions fell by 4,293 to 115,729. As a result, the gap between long and short positions widened by 9,921.

Indicator Signals:

Moving AveragesTrading is taking place below the 30- and 50-period moving averages, indicating further downside for the pair.Note: The periods and prices of the moving averages are based on the H1 chart, which may differ from classic D1 averages.

Bollinger Bands If the pair declines, the lower band around 1.1475 will serve as support.

Indicator Descriptions:

- Moving Average (MA) – Indicates the current trend by smoothing out price fluctuations and noise. 50-period shown in yellow, 30-period in green.

- MACD (Moving Average Convergence/Divergence) – Fast EMA: 12; Slow EMA: 26; Signal SMA: 9.

- Bollinger Bands – Period: 20.

- Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific criteria

- Non-commercial long positions – Total long open positions held by non-commercial traders.

- Non-commercial short positions – Total short open positions held by non-commercial traders.

- Net non-commercial position – The difference between long and short positions held by non-commercial traders.