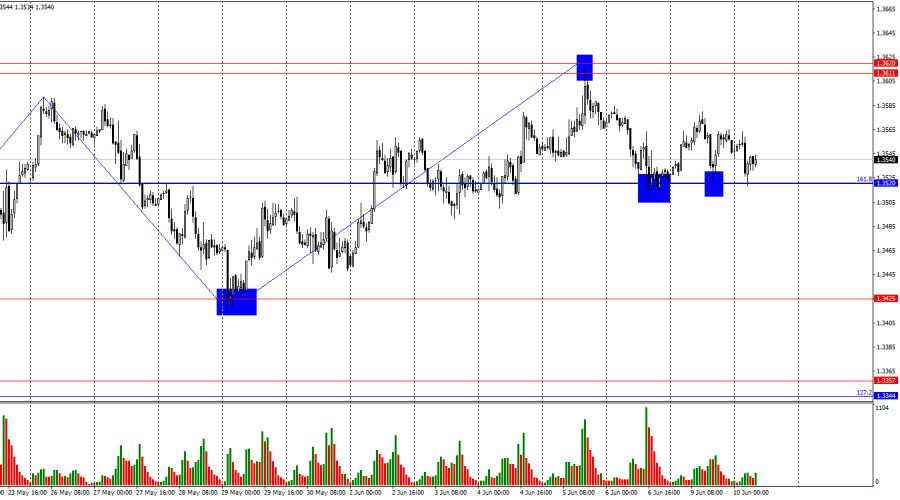

On the hourly chart, the GBP/USD pair on Monday made two rebounds from the 161.8% corrective level at 1.3520 but failed to start an upward movement. Today, on Tuesday, the pair consolidated below this level, allowing for expectations of continued decline toward the 1.3425 level and the support zone of 1.3344–1.3357. Bears unexpectedly launched a sharp offensive.

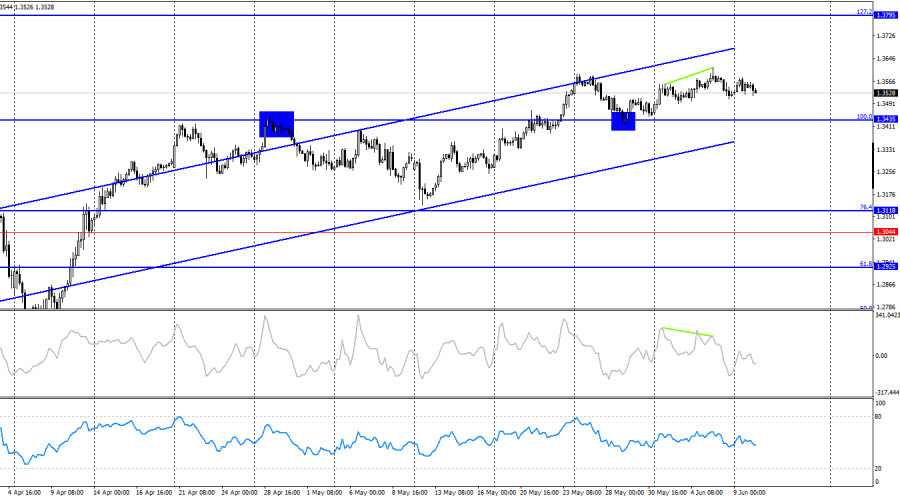

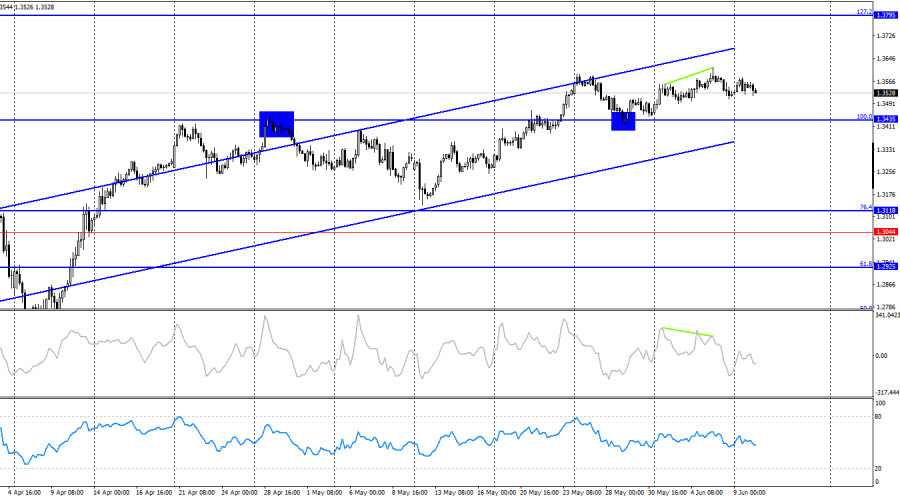

The wave pattern clearly points to the continuation of a bullish trend. The most recent upward wave broke through the previous wave's peak, while the most recent downward wave did not break the previous low. Bulls will find it difficult to rely on further growth without new announcements from Donald Trump regarding the increase or imposition of new import tariffs. However, the U.S. President remains ready to raise tariffs and escalate immigration-related actions. Thus, bulls still have reasons to initiate new attacks.

On Monday, the news backdrop was absent, explaining the low trading activity. Today, the situation has turned 180 degrees. In the morning, the UK released reports that, at first glance, did not appear especially significant. Unemployment figures, while important, usually cause only a restrained market reaction. Yet, within less than two hours, the pound lost about 85 points as unemployment rose to 4.6% — exactly as traders had expected. However, the number of unemployed rose by 33,000 in May, three times higher than the anticipated 10,000. This partly triggered the selling of the British pound. The wage growth report showed a 5.3% increase, which indirectly points to slowing inflation and increases the likelihood of further monetary easing by the Bank of England. While it's still too early to talk about another rate cut in the UK, these three reports combined gave bears significant support. In my view, however, the market overreacted — this aggressive bearish move was a surprise, especially considering the market has barely sold the pair even on stronger news in the past four months.

On the 4-hour chart, the pair previously consolidated above the 100.0% Fibonacci level at 1.3435 and rebounded from it from above. However, a renewed upward move toward the 127.2% correction level at 1.3795 is possible if there is another rebound from 1.3435. The bullish trend is still intact, but a close below 1.3435 would suggest a drop toward the 76.4% level at 1.3118. A bearish divergence has formed on the CCI indicator, which led to a pullback to 1.3435. I still don't expect a significant decline in the pair for now.

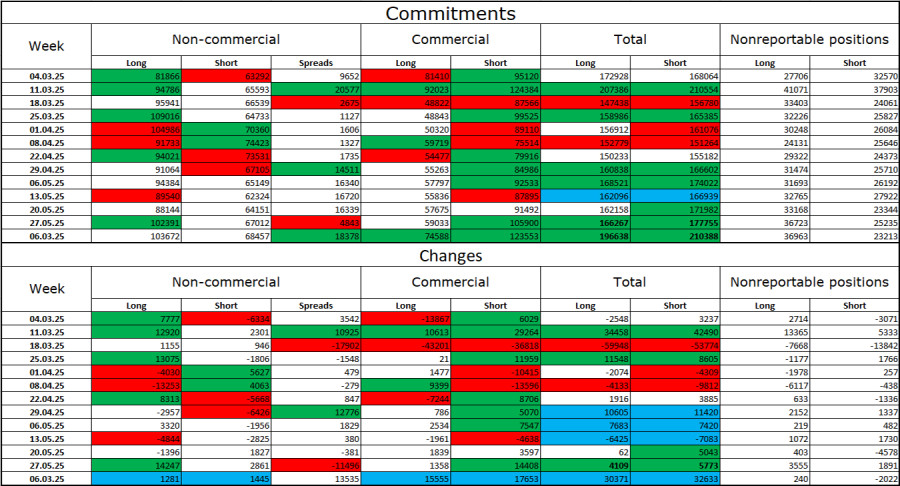

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" trader category did not change significantly last week. The number of long positions among speculators increased by 1,281, while short positions increased by 1,445. Bears have long lost the upper hand in the market. The gap between long and short positions stands at 35,000 in favor of the bulls: 103,000 vs. 68,000.

In my view, the pound still has room for decline, but recent developments have shifted the market's long-term sentiment. Over the past three months, long positions have grown from 65,000 to 103,000, while short positions have decreased from 76,000 to 68,000. Under Donald Trump, faith in the U.S. dollar has weakened, and COT reports show that traders have little desire to buy the dollar. Regardless of the overall news environment, the dollar continues to fall amid Trump-related developments.

Economic Calendar for the U.S. and UK:

- UK – Unemployment Rate (06:00 UTC)

- UK – Change in Claimant Count (06:00 UTC)

- UK – Change in Average Hourly Earnings (06:00 UTC)

On Tuesday, the economic calendar includes these three UK reports, which have already been released and triggered a strong bearish response. For the remainder of the day, the news background is not expected to influence trader sentiment significantly.

GBP/USD Outlook and Trading Advice

Selling the pair was possible after the rebound from the resistance zone of 1.3611–1.3620 on the hourly chart, with a target of 1.3520 — which has already been reached. New short positions were possible upon closing below 1.3520, with targets at 1.3425 and 1.3357.Buying opportunities will arise if there is a rebound from 1.3425 or the 1.3357–1.3344 zone.

Fibonacci Level Grids:

- On the hourly chart: from 1.3205 to 1.2695

- On the 4-hour chart: from 1.3431 to 1.2104