The GBP/USD currency pair traded lower on Tuesday, but the decline was weak, just like the volatility. Just look at the most recent stretch of the GBP/USD movement! Can we say the market is tired of selling the dollar and preparing for a serious correction? The British pound still grows for any reason—or no reason at all. And when the market finds no reason to open new longs, it just stalls and waits for news. And news for the dollar, unfortunately, has been more negative than positive. However, it's essential to distinguish the valuable elements from the worthless ones in this situation. There has been and still is positive news for the dollar. For example, the Federal Reserve's monetary policy remains hawkish in 2025, unlike the Bank of England, which has already cut rates twice, and unlike the European Central Bank, which cuts rates at every meeting.

But none of these factors interest traders right now. They're only interested in Trump and his decisions on large-scale, global issues—like trade policy. And here, there's very little positive news for the U.S. dollar. As soon as signs of de-escalation in the trade conflict appeared, the dollar at least stopped falling daily. For a month, the U.S. currency traded sideways against the pound and gained slightly against the euro. However, as soon as Trump started "picking fights" again with the EU and China, imposing new tariffs and raising old ones, and the U.S. judicial system suffered a collapse, the dollar resumed its decline.

As we said in the previous article about the euro, Trump's main targets are China and the EU. China has been growing and developing too quickly in recent years and poses a real threat to the U.S. for global leadership. The EU is a very wealthy region from which much money can be extracted. Why not take advantage of that? China can also be made to pay more for "constantly stealing" U.S. technologies and profiting from American markets by selling vast quantities of goods there. Moreover, many American goods are produced in China. So, Trump decided these "sheep" need to be "shorn" a bit.

What will come of it remains to be seen. Brussels and Beijing are not run by fools either. They fully understand what Trump is trying to achieve and what he's aiming for. Trump is hardly interested in negotiations and trade deals with small countries whose turnover is just a few billion dollars. Sure, American consumers will have to pay tariffs on Hungarian or Serbian goods, exports from these countries will shrink, and their economies will suffer—but what's the benefit to the U.S.? And by the way, American consumers will pay all the tariffs regardless of the outcome. It's the U.S. government that will profit. And to keep Americans from grumbling too much, taxes will be lowered—of course, much less than what will be "eaten up" by tariffs.

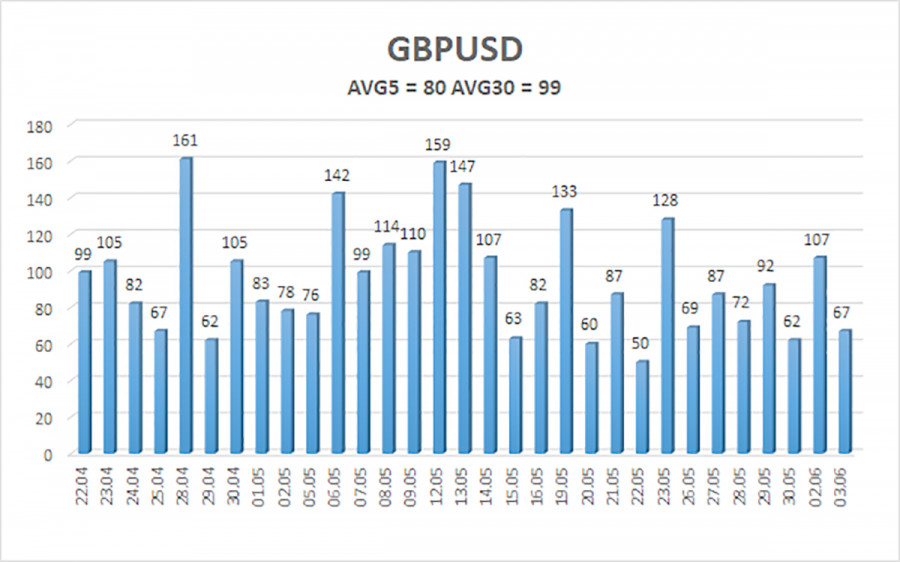

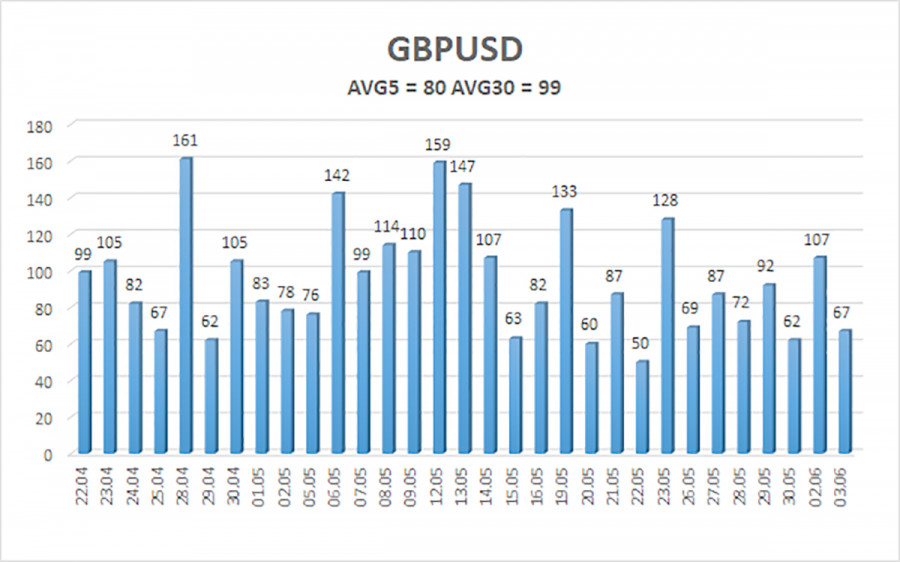

The average volatility of the GBP/USD pair over the last five trading days is 80 pips, which is considered "moderate" for the pound/dollar pair. On Wednesday, June 4, we expect the pair to move between 1.3445 and 1.3605. The long-term regression channel is directed upward, indicating a clear uptrend. The CCI indicator hasn't entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains an uptrend and continues to rise. There's plenty of news supporting this movement. The de-escalation of the trade conflict ended as soon as it began, but the market's dislike of the dollar persists. Every new decision from Trump—or anything related to Trump—is perceived negatively by the market. Thus, long positions remain possible with targets at 1.3605 and 1.3672 if the price stays above the moving average. A consolidation below the moving average would allow for short positions with targets at 1.3428 and 1.3306. But who's expecting a strong dollar rally right now? Occasionally, the dollar might show minor corrections, but substantial growth would require real signs of trade war de-escalation.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.