GBP/USD 5-Minute Analysis

The GBP/USD currency pair broke out of its sideways channel through the upper boundary, paused briefly to "think it over," waited for new aggressive moves from Trump, and then confidently transitioned into another upward surge. We've already discussed the reasons behind the latest drop in the U.S. dollar. There could be many more such drops simply because another one of Trump's "brilliant" plans has "somehow" failed again. Trump was counting on all the countries on his "blacklist" rushing to appease him during the three-month grace period, leaving him with nothing to do but sign 75 trade deals and declare total victory over the injustice and exploitation of the United States "that's gone on for decades." We assumed that smaller countries would try to make deals with Washington since losing access to the U.S. market would be a heavy economic blow.

However, it turns out that not only the EU or China are unwilling (or unable) to negotiate, but there's also no information about deals or negotiations with smaller countries. It remains unclear whether any talks are happening with anyone at all. As for statements from the White House, they're not worth paying attention to. According to Trump and his team, the U.S. economy is growing. If it's not growing, it's Biden's fault. If it's shrinking, it's temporary. There are no deals, the U.S. president is furious, and new tariffs are on the table. What else should the market do but dump the "conflict currency"?

On the 5-minute chart, Friday's trading signals were suboptimal as the market grew nervous over Trump's campaign for global justice. Ironically, the Republican president is now considering tariffs against Apple, which "for some reason" refuses to relocate production back to the U.S.

COT Report

COT reports on the British pound show that commercial trader sentiment has fluctuated constantly in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, cross each other frequently and usually hover around the zero mark. They are close together again, indicating a roughly equal number of long and short positions. However, the net position has shown steady growth over the past year and a half.

The dollar continues to weaken due to Donald Trump's policies, so market makers' demand for the pound is not particularly important now. If a global trade war de-escalation resumes, the U.S. dollar may have an opportunity to strengthen — but that opportunity still needs to be seized.

According to the latest report on the British pound, the "Non-commercial" group closed 1,400 long contracts and opened 1,800 short contracts, resulting in a 3,200 decrease in the net long position.

The pound has surged significantly recently, but it's important to understand that the only reason is Trump's policy. Once that factor is neutralized, the dollar may begin to rise again. The pound itself has no intrinsic growth drivers. Nevertheless, the "Trump factor" is enough for traders to base decisions on now.

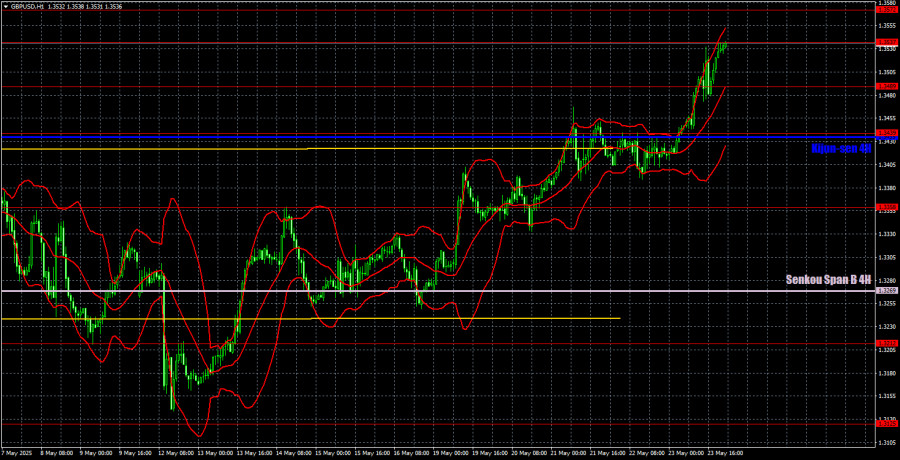

GBP/USD 1-Hour Analysis

On the hourly timeframe, the GBP/USD pair broke out of its sideways channel, this time through the upper boundary. Further movement now depends entirely on Donald Trump and developments in the global trade war. However, we can also say that the movement depends on general sentiment toward the U.S. and its president personally. At the moment, that sentiment remains sharply negative. The dollar continues to fall — and when tariff headlines appear, it falls twice as hard.

For May 26, the key levels to watch are 1.2863, 1.2981–1.2987, 1.3050, 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3572, 1.3637–1.3667, and 1.3741. The Senkou Span B line (1.3269) and the Kijun-sen line (1.3435) may also provide trading signals. Once the price moves 20 pips in the right direction, a stop loss should be moved to breakeven. Ichimoku indicator lines may shift throughout the day and should be factored into signal assessments.

No critical or noteworthy events are scheduled for Monday in the U.K. or the U.S., but the dollar may continue its next wave of decline.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.