On Tuesday, the GBP/USD currency pair continued its upward movement. Although this rally was not as strong as last week's surge, the British pound kept rising steadily, with barely any correction. There was no macroeconomic basis for the pound's significant growth on Monday and Tuesday. Some interesting reports were published in the UK on Tuesday, but British data either supported the pound or was ignored by traders for several months.

And that's precisely what happened on Tuesday. The unemployment rate remained unchanged, jobless claims came in only slightly below forecasts, and wage data almost precisely matched expectations. In short, the whole batch of reports was neutral. It certainly wasn't strong enough to justify the pound gaining another 50 pips during the European session — on top of the 1,000-pip rise it has seen in recent months.

We've noted that the pound's 10-cent gain against the dollar isn't due to any inherent strength. The UK economy continues to struggle and is growing very slowly. Recently, the Bank of England hasn't given off dovish signals (unlike the European Central Bank), but the Federal Reserve hasn't rushed to cut rates either. In short, the BoE and the Fed have nearly identical monetary policy stances — yet only the pound is rising.

We believe the primary driver behind the pair's rise is Donald Trump's tariff policy — or, more accurately, the U.S.'s new trade policy. The tougher it becomes toward the rest of the world, the more pressure the dollar is likely to face. Even though the trade war is causing a global economic slowdown, only the dollar is falling. And that's not surprising, as the U.S., being the world's largest economy, is held to a higher standard than the EU or the UK. Additionally, traders and investors fear that this trade war won't be the end of it.

What if the U.S. and China fail to reach a trade agreement? That would effectively halt trade between the world's two largest economies. Needless to say, Chinese and American companies would suffer massive losses, lay off workers, and shut down production. China will have difficulty finding new export markets to replace the U.S. since it has already flooded the global market with goods. Meanwhile, American consumers will lose access to cheap Chinese products. Prices will spike, and there won't be affordable alternatives. Sure, there are workarounds through third countries, but Trump appears to have anticipated this and imposed tariffs on nearly every country. There are no signs of de-escalation at this point, and the market squarely blames Trump for the trade war — and is taking it out on the dollar.

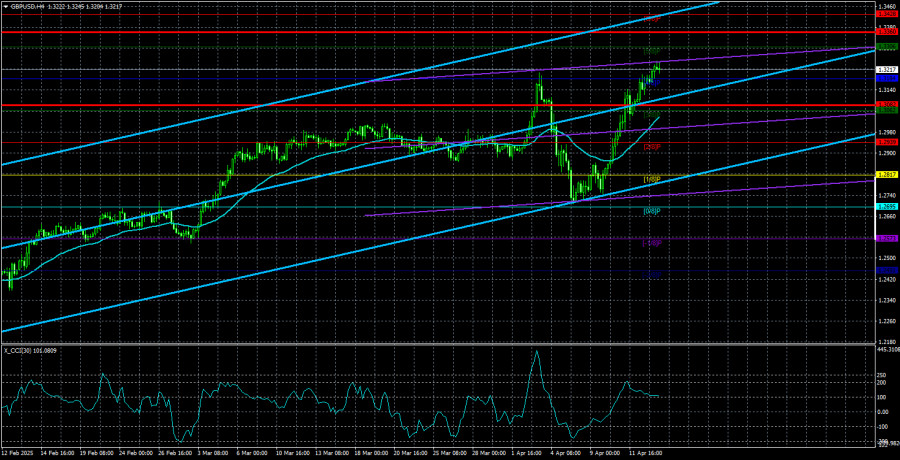

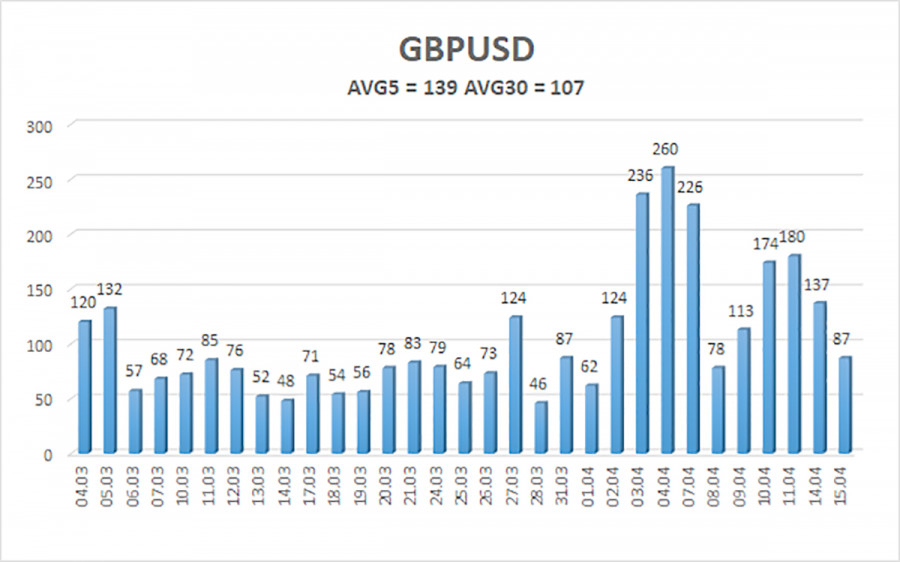

The average volatility of the GBP/USD pair over the last 5 trading days stands at 139 pips, which is considered high for this pair. On Wednesday, April 16, we expect the pair to move within the range of 1.3082 to 1.3360. The long-term regression channel is sloping upward, although the downtrend remains on the daily chart. The CCI indicator entered the overbought zone, which pointed to a downward correction — though this correction has already played out.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair has resumed its upward trend. We still do not recommend long positions, as we believe the entire upward move is a correction within the daily timeframe, and it has already become illogical. However, if you're trading based on pure technicals or "on Trump," long positions remain relevant with targets at 1.3360 and 1.3428, as the price remains above the moving average.

Short positions are still attractive with targets at 1.2207 and 1.2146 because this bullish correction on the daily chart will end sooner or later — unless the long-term downtrend ends before that. Currently, with Trump frequently announcing new tariffs or increasing existing ones, the dollar continues to decline.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.