Analysis of Trades and Trading Tips for the Euro

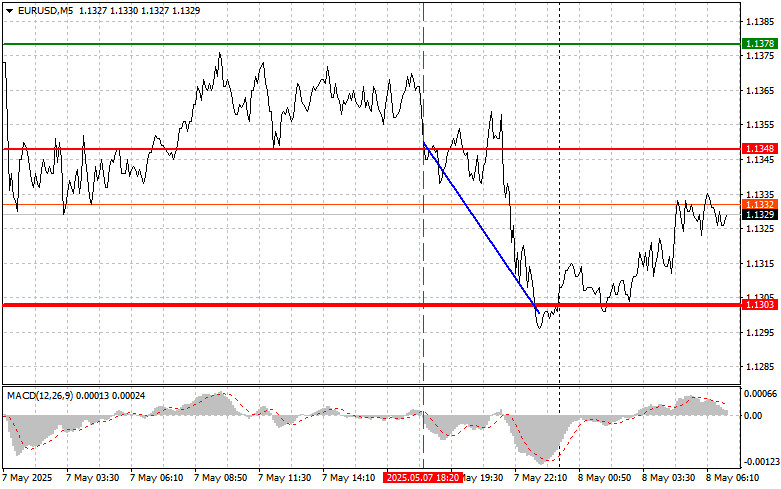

The test of the 1.1348 price level in the second half of the day coincided with the MACD indicator just starting to move downward from the zero line, confirming the correctness of the sell entry point for the euro. As a result, the pair fell toward the target level of 1.1303.

Yesterday, the Federal Reserve left interest rates unchanged at 4.50%. This decision was largely in line with market expectations and reflects the central bank's cautious approach to the current economic situation, which is characterized by balanced growth and moderate inflation. However, the accompanying statement from Federal Reserve Chair Jerome Powell, in which he emphasized the potential risks associated with introducing trade tariffs, added some uncertainty to the outlook for monetary policy. Specifically, Powell noted that tariffs could lead to higher inflation, as imported goods would become more expensive, and a slowdown in economic activity, as businesses face higher costs and uncertainty about future trade. According to him, these factors could warrant a reassessment of the Fed's current policy, though he stressed that the central bank is in no hurry to make any adjustments. The market's response to Powell's remarks was subdued. Investors seemed to take both the positive and negative elements of his speech into account. Going forward, the Fed's actions will largely depend on incoming economic data and the development of trade relations.

This morning, data on the changes in Germany's industrial production and trade balance are expected to be released. These indicators generally do not significantly impact the dynamics of the euro, but they offer some insight into the state of the German economy. If industrial production increases, the euro could respond with a modest rise. Special attention will be paid to the manufacturing component, as this sector is the key driver of the German economy. Expectations for the trade balance will also play a role. A trade surplus exceeding forecasts could support the euro, while a deficit or decline in the indicator could pressure the European currency.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

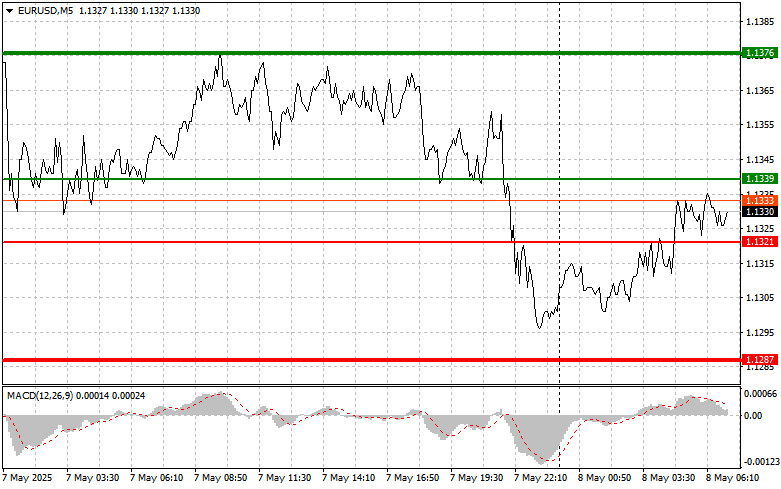

Scenario 1: Today, I plan to buy the euro upon reaching the price area around 1.1339 (green line on the chart), with a target of rising to 1.1376. At the 1.1376 level, I intend to exit the market and sell the euro on the pullback, expecting a 30–35 pip movement from the entry point. A substantial rise in the euro can be expected if good reports are released. Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1321 price level when the MACD indicator is in the oversold zone. This would limit the pair's downside potential and lead to an upward market reversal. A rise toward the opposite levels of 1.1339 and 1.1376 can be expected.

Sell Scenario

Scenario 1: I plan to sell the euro after reaching the 1.1321 level (red line on the chart). The target will be the 1.1287 level, where I plan to exit the market and immediately buy on the rebound (expecting a move of 20–25 pips in the opposite direction). Selling pressure on the pair may return at any moment today. Important: Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1339 price level when the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a downward market reversal. A drop toward the opposite levels of 1.1321 and 1.1287 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.