was formed on 20.05 at 18:00:36 (UTC+0)

signal strength 1 of 5

signal strength 1 of 5

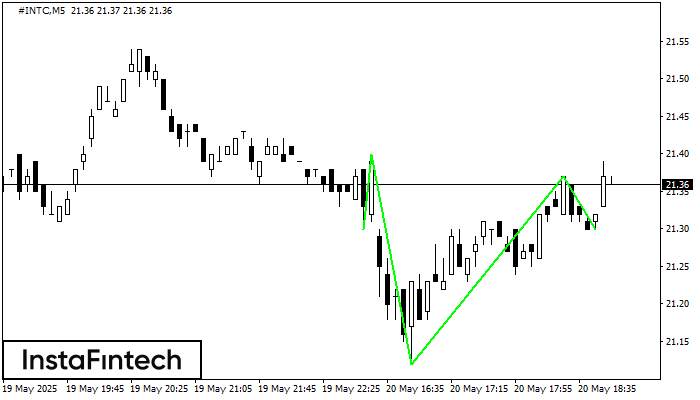

According to the chart of M5, #INTC produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 21.12 while the median line of the Neck is set at 21.40/21.37. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of #INTC will go towards 21.52.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength